ESG and CSR: What You Need to Know?

The phrase corporate social responsibility (CSR) is often used interchangeably with ESG, but this isn’t entirely accurate, as CSR is broader in scope than ESG.

Let’s take a look at what these terms mean and why it’s important to understand the differences between them.

How Does Your Company Measure Up?

What does ESG mean in business?

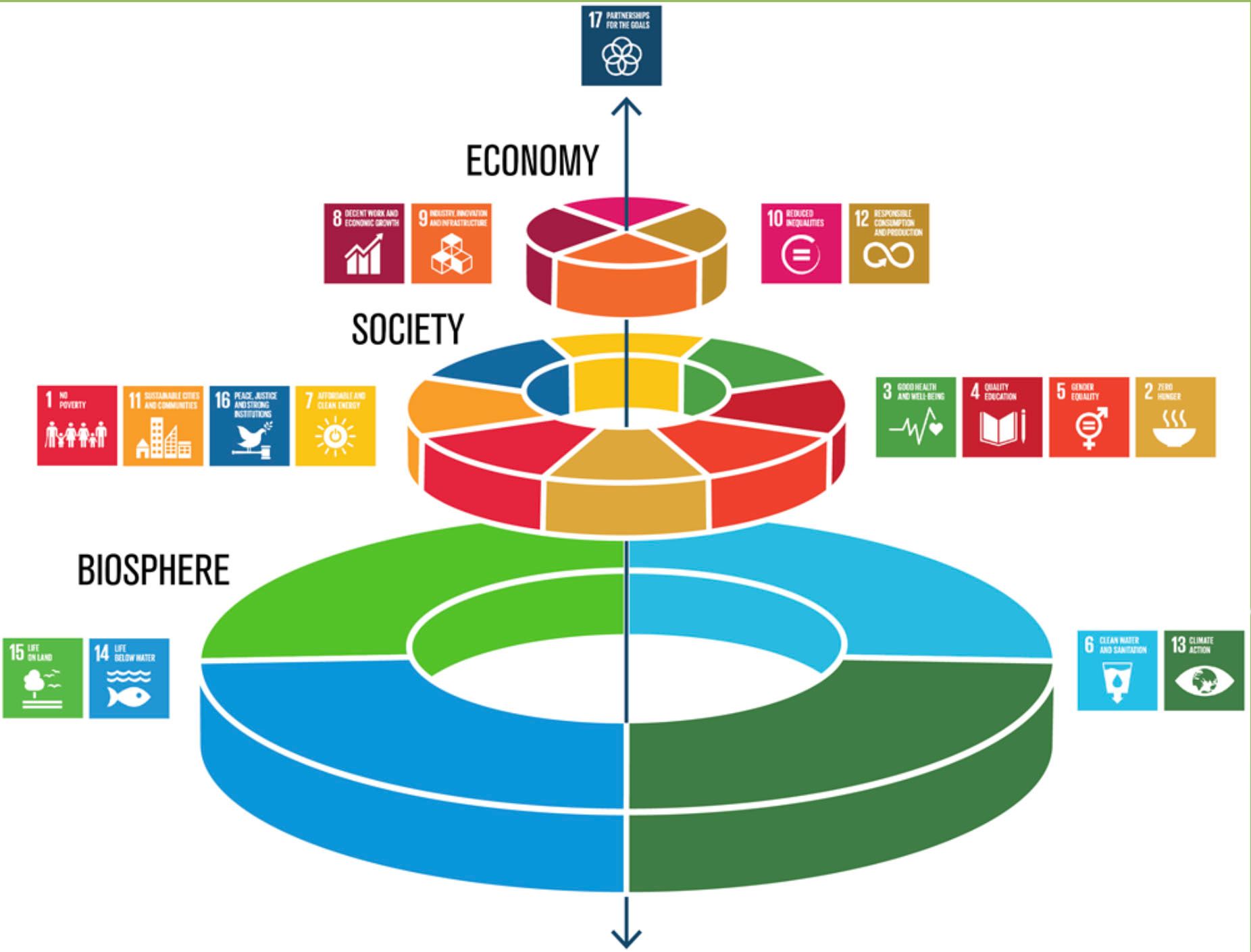

ESG is a big buzzword in business today. It stands for Environmental, Social, and Governance, which encompasses corporate social responsibility (CSR) programs as well as environmental sustainability practices. The most common ESG topics include fossil fuel use and climate change; water pollution; air pollution; recycling; sustainable supply chains; human rights violations/corruption/labor abuse. In other words, companies are going green by making sure they’re not harming society or hurting their communities or employees. But what does it all mean? And why should you care?

The good news is that firms that don’t work to improve their sustainability have a higher risk of dropping in value than those that do. According to one study, companies with low ESG scores had lower long-term shareholder returns than those with high scores. This means investors can use ESG scores when determining which companies are financially sound – and which aren’t worth investing in at al.

How do you implement an ESG?

- Set Overall Goals.

- Create a budget for your ESG goals.

- Figure out what changes need to be made.

- Measure your performance against your standards

- Encourage knowledge sharing through training opportunities.

- Incorporate ESG values into marketing efforts by tying sustainability messages to products or services offered.

When it comes to incorporating ESGs into your business, remember that every business is different, so it’s important for you to figure out how you can best incorporate these initiatives into your operations and make them part of company culture.

Your goals may not be exactly like another organization’s goals, but adopting an ESG mindset allows you to create a sustainable business model that builds value for employees, customers, investors and society as a whole.

Why Environmental, Social, Governance (ESG) is Important?

- Environmental refers to how a company operates from an ecological perspective.

- Social refers to how it acts in relation with its employees and supply chain.

- Governance refers to how it conducts itself publicly.

At times ESG can seem synonymous with Corporate Social Responsibility (CSR), but that isn't entirely accurate because CSR looks at only one dimension of corporate responsibility: societal factors.

Difference between sustainability and ESG

Some people consider sustainability as a broader category that includes both ESG factors, while others would argue that sustainability is only concerned with making sure we can sustain our environment for future generations. Because these terms are sometimes used interchangeably, it's important to clearly define what they mean before deciding how they apply to your business model.

What is the difference between ESG and CSR?

Although both ESG practices and CSR are important for any company hoping to do business in today's world , they should be thought of as different ways of practicing corporate citizenship. It all depends on your values, but if you're interested in influencing social change, chances are you want to focus on environmental issues (aka ESG). If, however, you just want to make sure your company is doing right by stakeholders—i.e., acting ethically and transparently—then CSR might be more up your alley.

The Benefits of Excellence in ESG Performance

Companies that invest in ESG excellence create stronger relationships with their customers, employees, regulators, shareholders and communities. In short: you can’t afford not to know what sustainability standards are relevant for your business. If you aren’t already familiar with these topics (especially if your company has never before been rated by an independent third party), now is a great time to get caught up on both corporate social responsibility (CSR) and environmental, social & governance (ESG) standards.

Benefits of excellence in ESG performance include increased profitability, better employee retention rates, greater market awareness among customers and improved investor trust. And if you’re planning on making any new investments or taking over another company anytime soon, chances are it will be easier—and cheaper—to do so if your portfolio is certified as compliant with industry-specific ESG best practices. Sustainability Standards and ESG standards are growing as more companies—in more countries—are adopting them. As we’ve said before, committing your company to ESG excellence has a lot of benefits and can save you money in a number of different ways. We’re guessing that many other companies will come around to our way of thinking on these issues soon enough; if you don’t want your business left behind when they do, now is a great time to learn more about ESG standards!

People-Centric Products and Services

Unilever: Since 2008, Unilever has reduced its water usage by 43% across its entire product range. The company has taken more than 600 measures to improve efficiency at 14 different sites around Europe, including installing solar panels at several manufacturing plants and repurposing water used during processes back into raw materials.

Nestlé and Danone are both multinational food companies. In addition to having high ESG ratings, both companies have a strong reputation for becoming more sustainable in their business practices and products.

Danone is an international food company aiming to become the world's largest B Corp. The company's B-Corp certification demonstrates its strong ESG performance. Additionally, Danone's strong animal welfare program has transformed the company over the past five years from a laggard to a leader in this regard. Moreover, the company has set itself the goal of becoming carbon neutral throughout its entire value chain by 2050 in order to counteract global warming.

Nestlé , a Swiss multinational food and beverage company, is also known for its sustainability initiatives.

Engaging with Stakeholders

Responsible Innovation

ESG Examples

- Luckily, there are many concrete examples of companies who have implemented sustainable practices in their operations. Some companies have gone so far as to make transparency reports public so anyone can see just how they incorporate ESG into their business model. This transparency helps demonstrate a company’s commitment—it's much harder for investors or stakeholders to point out problems when you're already showing them you're making an effort. ESG examples include

- Coca-Cola Company scored 91/100 on its 2016 sustainability report card from Sustainalytics; it has taken steps to reduce water use, greenhouse gas emissions and waste by investing in renewable energy sources such as solar panels at facilities across five continents. In 2015 alone, it reduced water usage by 9 percent per unit produced compared with 2006 levels while increasing production volume by 4 percent overall. It also uses 100 percent recycled plastic bottles worldwide (including refillable ones).

- Unilever is the third-largest consumer products company worldwide in terms of sales, with 400 global and local brands, including brands such as Dove, Lux, Axe, Rexona, Knorr, and Lipton, worth more than 13 billion Euros. Over the past decade, they have established themselves as leaders in environmental, social and corporate governance (ESG), actively contributing to a green agenda.

As part of its commitment to the UN Sustainable Development Goals, today the company pledges to work toward achieving net-zero emissions in the making and use of its products by 2039. In addition, Unilever is committed to improving millions of people's livelihoods through fair and inclusive business practices. Most recently, the company announced additional measures to support more SMEs in the extended value chain, including minority owned businesses.

Conclusion